The Appeal of Garden-View Properties in Bangalore

Read latest blogs and articles from Housystan

The Information mentioned here was last updated on:

17/2/2026The Allure of Garden-View Properties in Bangalore: Why Green Spaces are the New Urban Luxury

Introduction: A Green Revolution in Urban Living

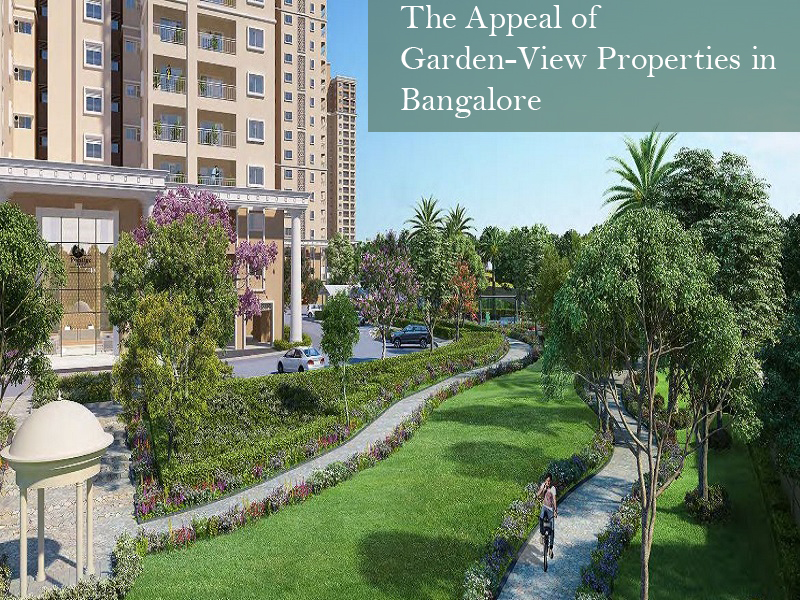

Bangalore, often dubbed the “Garden City of India,” has seen its urban landscape evolve rapidly over the past two decades. High-rise buildings, tech parks, and bustling roads have come to define the city’s skyline. Yet, amid this urban sprawl, there’s a growing demand for homes that offer tranquil vistas and a direct connection to nature. Garden-view properties in Bangalore have emerged as a coveted choice among homebuyers, offering a unique blend of comfort, serenity, and modern amenities. But what exactly is fueling this trend, and why are garden-facing homes in such high demand?

- Verified Tenants/Buyers

- Unlimited Property Listing

- Zero subscription/charges fee

The Psychological and Physical Benefits of Green Spaces

Countless studies have shown that proximity to greenery can significantly improve mental health and overall well-being. In a city like Bangalore, where work-life balance can often be skewed, the ability to unwind in a garden-facing home is a luxury that resonates with many. Residents enjoy the calming view of lush lawns, vibrant flower beds, and mature trees—elements that foster relaxation and reduce stress. For families with children or elderly members, having a green space just outside the window means more opportunities for recreation and socialization, all within a safe and controlled environment.

Premium Living Without Leaving the City

For many, the appeal of garden-view properties lies in their ability to offer a peaceful retreat without sacrificing urban conveniences. Developers in Bangalore now prioritize landscaped gardens, walking trails, and open spaces within gated communities. These features not only enhance the aesthetic value of the property but also contribute to a healthier lifestyle. Whether it’s a morning jog along tree-lined pathways or enjoying a cup of tea on a balcony overlooking manicured lawns, residents experience a harmonious blend of urban living and natural beauty.

Environmental Impact and Sustainable Development

The real estate sector in Bangalore is increasingly embracing eco-friendly designs and sustainable practices. Garden-view homes typically form part of larger, master-planned developments that prioritize environmental stewardship. Features such as rainwater harvesting, native plant landscaping, and organic waste management are common in these communities. By integrating gardens and green belts, developers not only enhance property values but also help combat the city’s notorious air pollution and urban heat island effect. For environmentally conscious buyers, a garden-facing property is more than just a luxury—it’s a responsible investment in Bangalore’s future.

Enhanced Property Value and Market Demand

Garden-view properties consistently command a premium in Bangalore’s competitive real estate market. Whether it’s a compact 2BHK apartment or a sprawling villa, homes with garden-facing views attract higher resale values and rental returns. The reason is simple: green spaces are finite in a rapidly urbanizing city, making them a rare commodity. Investors recognize that homes overlooking landscaped gardens are more desirable and likely to appreciate over time. Furthermore, these properties tend to attract long-term tenants, particularly expatriates and professionals who value a healthy, balanced lifestyle.

The Rise of Gated Communities and Integrated Townships

Bangalore’s real estate evolution has seen a surge in gated communities and integrated townships, many of which are designed around extensive green spaces. Projects in neighborhoods like Whitefield, Sarjapur Road, and North Bangalore offer residents a secure, holistic living environment with amenities such as clubhouses, sports courts, and community gardens. The presence of expansive gardens not only enhances the aesthetic appeal of these developments but also encourages community interaction and outdoor activities. Homebuyers are increasingly seeking out such projects, citing safety, privacy, and access to green spaces as top priorities.

A Haven for Families and Pet Owners

For families, the advantages of garden-view properties are manifold. Children have safe play areas away from busy streets, while parents can keep a watchful eye from the comfort of their balconies or living rooms. Pet owners, too, find these properties ideal, as pets have ample space to exercise and socialize. In a bustling city where private outdoor space is a rarity, garden-facing homes provide a lifestyle upgrade that’s hard to match.

Design Innovations and Customization

Developers are getting creative with how gardens are integrated into residential complexes. Vertical gardens, rooftop terraces, and themed landscapes are increasingly common. Some properties offer private garden patches for ground-floor units or exclusive terrace gardens for penthouses. These design innovations allow homeowners to personalize their green spaces, whether it’s growing organic vegetables, cultivating exotic flowers, or simply creating a tranquil spot for meditation. The flexibility to customize outdoor spaces adds a personal touch that many Bangaloreans crave in an otherwise uniform urban environment.

Connectivity and Accessibility

Another factor driving the appeal of garden-view properties in Bangalore is their strategic location. Many of these developments are situated close to major IT hubs, educational institutions, and healthcare facilities. This ensures that residents don’t have to compromise on connectivity while enjoying a green lifestyle. Easy access to arterial roads and public transportation further enhances the convenience factor, making garden-facing homes an attractive proposition for working professionals and families alike.

Future Trends: The Growing Importance of Green Living

As Bangalore continues to expand, the importance of integrating green spaces into urban planning will only grow. Homebuyers are becoming more discerning, prioritizing quality of life over mere square footage. Developers, in turn, are responding with projects that emphasize sustainability, wellness, and a close connection to nature. Garden-view properties are at the forefront of this shift, offering a glimpse of what future living in Bangalore could look like—harmonious, healthy, and deeply rooted in the city’s green legacy.

Conclusion: Garden-View Homes—A Wise Investment and a Lifestyle Choice

The appeal of garden-view properties in Bangalore goes far beyond their visual charm. They represent a lifestyle choice that prioritizes well-being, sustainability, and a sense of community. As the city’s residents seek refuge from the urban grind, these homes stand out as sanctuaries of peace and rejuvenation. Whether you’re a first-time homebuyer, a seasoned investor, or someone simply looking to reconnect with nature, choosing a garden-facing property in Bangalore could be one of the wisest decisions you make for your family—and for yourself.